Discover the Best Lenders for Debt Consolidation: Your Complete Guide

Juggling multiple debts is more than just a financial headache. It’s a constant source of stress.

You have a credit card payment due on the 5th, a personal loan on the 15th, and a medical bill on the 28th.

Each debt has its own interest rate, its own due date, and its own monthly payment. It’s a mental load that can feel overwhelming.

Worse, if those debts have high interest rates, you can feel like you’re barely making a dent in what you actually owe.

Debt consolidation is a strategy designed to fix this. It’s about simplifying your financial life and, in most cases, saving you a significant amount of money.

But to do it right, you need to find the right lender.

What is Debt Consolidation, Really?

Let’s clear up what this term means.

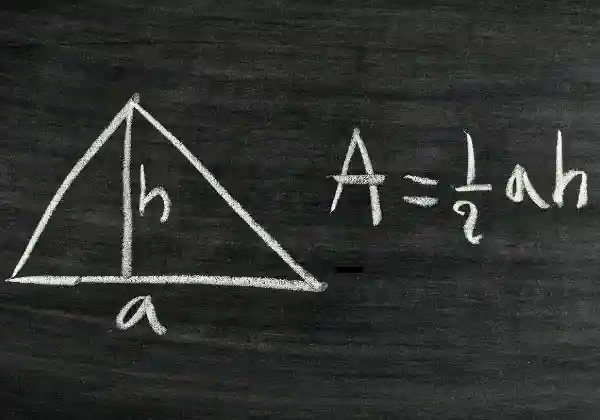

Debt consolidation is the process of taking out one new loan to pay off multiple old debts.

Instead of juggling five different payments, you now have just one single monthly payment to worry about.

The goal is twofold:

- Simplicity: You have one due date, one interest rate, and one payment. It’s much easier to manage.

- Savings: The new loan should have a lower interest rate than the average rate of your old debts. This means less money goes to interest and more goes to paying down your actual debt, helping you get out of debt faster.

The most common way to do this is with a personal loan specifically for debt consolidation.

Where to Find the Best Lenders: The Top Options

When you’re looking for a debt consolidation loan, you have several options. The best one for you will depend on your credit score and financial situation.

1. Online Lenders (The Modern Choice)

Companies like SoFi, LightStream, and Marcus by Goldman Sachs have revolutionized the lending industry.

- Why they’re great: Their application process is typically fast, simple, and entirely online. You can often get pre-qualified with a soft credit check, which won’t hurt your credit score. This allows you to shop around for the best rates without any commitment.

- Best for: People with good to excellent credit who want a streamlined, digital-first experience and competitive interest rates.

2. Traditional Banks (The Familiar Face)

Your own bank, whether it’s a large national institution like Chase or Bank of America, or a smaller local bank, is a great place to start.

- Why they’re great: If you have an existing relationship with a bank, they might be more willing to offer you favorable terms. You also have the benefit of being able to walk into a branch and speak with someone face-to-face.

- Best for: People who value an in-person relationship and may get a loyalty discount for being an existing customer.

3. Credit Unions (The Community-Focused Option)

Credit unions are non-profit financial institutions owned by their members. This often translates to better deals for you.

- Why they’re great: Because they are not-for-profit, credit unions often offer lower interest rates and more flexible lending criteria than traditional banks. They are known for their excellent customer service.

- Best for: People who might have a less-than-perfect credit score. Credit unions are often more willing to look at your whole financial picture, not just your score.

What to Look For in a Lender

When you’re comparing offers, don’t just look at the interest rate. Consider the whole package.

- APR (Annual Percentage Rate): This is the most important number. It includes the interest rate plus any fees, giving you the true cost of the loan.

- Origination Fees: Some lenders charge a one-time fee to process the loan, which is usually deducted from your loan amount. Look for lenders with zero origination fees.

- Loan Term: This is how long you have to repay the loan (e.g., 3, 5, or 7 years). A shorter term means higher monthly payments but less interest paid overall. A longer term means lower payments but more interest over time.

- Direct Payment to Creditors: The best lenders offer to send the loan funds directly to your old creditors. This saves you a step and ensures the old debts are paid off immediately.

Your Next Step

Debt consolidation isn’t a magic wand that makes debt disappear.

It’s a powerful strategy that simplifies your life, reduces your stress, and gives you a clear and often cheaper path to becoming debt-free.

Start by checking your credit score, then explore pre-qualification offers from a few different types of lenders.

Finding the right loan is the first major step toward taking back control of your finances.